From our partners, Aronson Capital Partners

Healthcare IT remains as one of the largest and fastest growing segments of government spending, with both civilian and military agencies issuing contract vehicles and task orders in an effort to structure and stabilize IT systems. Due to an expanding utilization of the cloud and accelerated digitization of records, federal agencies are struggling to meet requirements set by the federal government such as the Managing Government Records Directive.

Healthcare Motivations

The rapid growth of healthcare IT in the federal budget is being driven by requirements for the improvement of patient care; reduction of fraud, waste and abuse; and overall cost efficiencies through more efficient processes. The digitization of patient records allows doctors and medical professionals to utilize information in order to improve patient treatment. Along with individual treatment, record management creates massive amounts of data that medical professionals can use to analyze healthcare trends.

According to OMB’s “Improper Payments Overview,” federal agencies reported an improper payment rate of 3.5% in 2013. This resulted in approximately $106 billion of incremental costs. Medicare is one of the worst offenders in this group with improper payments of almost $50 billion, while Medicaid generated another $14.4 billion of losses. Reconciliation of these losses could finance nearly all of the major Healthcare IT procurement spending. The federal government therefore has made it an urgent priority to upgrade the inefficient systems in efforts to reign in the improper payments.

Lastly, next generation healthcare technologies and applications developed by the commercial sector are gaining traction by federal healthcare agencies. Research has shown that the cost of traditional billing is $1.58 per claim opposed to $0.85 for electronic billing. Improved cost efficiency will not only make federal healthcare programs more affordable for the government, but can make healthcare more affordable to the population.

M&A in the Federal Healthcare IT Market

Acquisitions of federal healthcare IT targets have accounted for 7% of all government services transactions in the last 12 months. On the supply side, there are a limited number of targets with F&O revenue streams, since most healthcare oriented agencies rely heavily on preferential awards. On the demand side, both traditional Department of Defense firms as well as Federal Civilian focused buyers are targeting healthcare IT acquisitions. The below exhibit summarizes examples of traditionally focused DoD firms that have acquired healthcare IT firms in efforts to diversify away from declining defense budgets and gain exposure to this more rapidly growing market.

Traditionally DoD Focused Healthcare IT Acquirers

Meanwhile, large businesses with an existing Federal Civilian presence also look for healthcare IT acquisition targets that either provide a new capability, contract vehicle, or customer access, as summarized below:

Traditionally Federal Civilian IT Acquirers

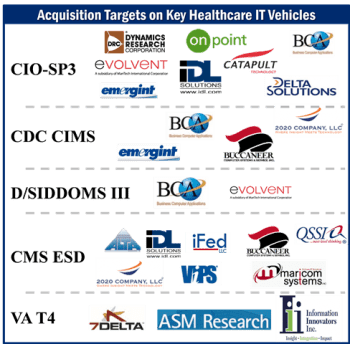

M&A Focus Key Contract Vehicles

Nearly all of the healthcare IT acquisitions have involved targets with a presence on a key contract vehicle. For example, 3 of the 9 small businesses on the $12 billion Veterans Affairs’ T4 IDIQ contract have been acquired by buyers seeking an entrance into the VA’s IT budget, including funding for VistA. The Veterans health Information Systems and Technology Architecture (VistA) houses over 2.5 million gigabytes of data around medical and pharmaceutical patient encounters, and makes it available for public analysis. Upon the eventual recompete of the VA T4 contract in 2016, we expect similar acquisition activity by acquirers that are not successful in the initial award.

The Centers for Medicare & Medicaid Services (CMS) Enterprise Systems Development (ESD) program was awarded in 2007pic 3 and will provide up to $4 billion for the design, development, testing, maintenance and other IT work intended to advance current data systems. Eight of the nine small businesses with the CMS ESD contract have been acquired.

There are similar examples of buyers making acquisitions to gain access to the key HCIT contract vehicles at other agencies, including NIH, CDC, and DHA.

Healthcare IT M&A Outlook

We expect buyers to continue to target healthcare IT acquisitions over the next 24 months. Despite rapid growth in healthcare IT, most public acquirers still derive less than 20% of their IT services revenues from healthcare agencies, and often have significant capability and customer gaps in this market.

In addition, there are a number of private equity backed acquirers focused on the healthcare IT space that are effectively executing on roll up strategies to accelerate growth, creating another segment of acquirers with ample access to capital. The main hurdle will continue to be the concentration of preferential awards amongst small business targets, and the lack of well positioned targets that are willing to exit in light of the optimistic outlook for this sector.

Orginal article can be found here: http://blogs.aronsonllc.com/aronsoncapitalpartners/rapid-growth-healthcare-continues/

About Aronson Capital Partners

Aronson Capital Partners is a leading M&A advisor to middle-market defense and government technology solutions providers. ACP provides a full range of M&A and corporate finance advisory services to enable their clients to achieve their growth and liquidity objectives. With an exclusive focus on the Government Services and Technology sector, ACP is able to provide clients with a unique industry perspective and access to longstanding relationships with the most active strategic buyers.

Leave A Comment